Critics have slammed the passage of the $430 billion Inflation Reduction Act during an inflationary period claiming it will do precisely the opposite of what its name implies. But in addition to the cost, the program will add 87,000 new agents to the Internal Revenue Service, and the newly appointed head of this not-so-small army of tax agents has a track record of partisan operations.

The Inflation Reduction Act is not cheap and is expected to raise taxes by some $300 billion over the next decade, mainly by creating two new taxes on corporations. The Tax Foundation estimates these new taxes will reduce the long-run size of the U.S. economy by 0.2%, eliminate 29,000 jobs and do nothing to tame inflation.

The new law allocated roughly $80 billion in new spending for the IRS. As plans to start spending the considerable sum of money began, the Department of the Treasury and IRS said that these new positions are for staffing of various roles. The agency would not increase its focus on people earning under $400,000. Still, it is difficult to understand how monitoring the taxes of people earning more than $400,000 would suddenly require an additional 87,000 agents, though the exact number of employees to be hired and their function is not yet known.

A Treasury official told Reuters that most of the new hires would go toward filling positions for 50,000 IRS employees who are on the verge of retirement and that the majority of net new hires would serve in customer service roles like upgrading IT systems or answering calls.

Contrary to this claim, however, a report by the Congressional Research Service showed that the largest increase in the IRS resulting from the Inflation Reduction Act would be in enforcement, giving the service $45.6 billion for tax enforcement activities, which would increase their current enforcement efforts by 69%. Much of this is expected to hire more enforcement agents, provide legal support, and invest in “investigative technology.” The funds could also be used to monitor and enforce taxes on digital assets such as cryptocurrency.

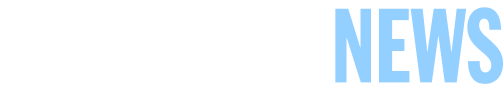

Many people are concerned about the White House beefing up the IRS. This concern grew when it was announced that Nikole Flax was chosen to lead the new “centralized office.”

In 2013, the IRS, under the Obama/Biden administration, revealed that it had selected political groups applying for tax-exempt status for intensive scrutiny based on their names or political themes. The issue remains unresolved as Lois Lerner, the director of the Exempt Organizations Unit of the IRS, obtained a court order to seal “in perpetuity” tapes and depositions she and other IRS officials gave in the court case concerning the issue. She also claimed not to have saved any relevant emails, testifying to Congress that the electronic files had been lost in a computer crash, a claim later determined to be false. No charges were ever brought, and none of the officials were penalized for their actions.

One of the IRS officials implicated in the targeting scandal was Nikole Flax, who served as Chief of Staff to Steve Miller, who at the time of the targeting was Deputy Commissioner and would later serve as Acting Commissioner of the IRS. Miller was fired for his role in the scandal though he retained his government pension. Flax was one of the seven IRS officials whose electronic records from that period went missing, as she claimed that her hard drive had crashed at the same time the computer glitch had wiped Lerner’s files. Flax was suspected of being involved in the IRS sending abusive questionnaires, including inappropriate demands for donor information, to conservative groups.

Instead of being penalized for her actions, Flax was promoted to deputy commissioner in charge of the Large Business & International Division. And now, she is being put in charge of 87,000 agents with a beefed-up enforcement budget.

The scandal in which Flax was implicated had the IRS targeting hundreds of conservative groups. This included constitutional groups, groups that criticized Obama, at least two pro-life groups, a Texas voting-rights group, a Hollywood conservative group, and at least one conservative Hispanic group. The partisan bias was undeniable as 10% of Tea Party donors were audited by the IRS, and 100% of the 501(c)(4) Groups Audited by the IRS Were Conservative.

At least five pro-Israel groups also claimed that the IRS was also targeting them. Z Street, a non-profit corporation dedicated to educating the public about various issues related to Israel and the Middle East, filed a lawsuit against the IRS. The organization applied for exempt status as a 501(c)(3) organization in 2009. Their suit alleged that the IRS implemented an internal review policy that subjected Israel-related organizations applying for tax-exempt status. Z Street claimed that this so-called “Israel Special Policy” represented impermissible viewpoint discrimination on the part of the federal government. During their review, Z Street was told by IRS agent Diane Gentry that she was concerned that Z Street was planning to engage in “advocacy” activities that are not permitted under 501(c)(3). Agent Gentry indicated that the IRS had “special concerns” about organizations whose activities relating to Israel contradicted the current policies of the US Government. These cases were sent to a special unit in the DC office to determine whether the organization’s activities contradict the Administration’s public policies. Z Street claimed that the IRS policies violated their First Amendment rights.

In a letter from IRS agent Tracy Dornette, Z Street was asked, “Does your organization support the existence of the land of Israel?” and told to “Describe your organization’s religious belief system toward the land of Israel.”

Ironically, a move by the IRS to dismiss was denied by Judge Ketanji Brown Jackson of the United States District Court For The District of Columbia; an Obama appointee Biden nominated in February to the Supreme Court.

The shortcode is missing a valid Donation Form ID attribute.